Jump to section

Introduction

We are excited to announce a new feature exclusively available to our FreeWill nonprofit partners: revocable living trusts (RLTs) in all 50 states and Washington, D.C.

Starting in May 2023, supporters can create RLTs in every state, expanding from the previous availability for California-based users. As a FreeWill nonprofit partner, your supporters can make an RLT for free through the branded landing page you send your supporters to create a will. They will have the option to select between a will or a trust.

FreeWill’s estate planning tools make it free and accessible for your supporters to make a gift commitment through their RLT, providing greater flexibility for them to make an impact on your mission. Learn more about RLTs and how to share resources with your supporters.

What is a Revocable Living Trust (RLT)?

A revocable living trust (RLT) is a legal document that allows an individual, or the “Grantor and Initial Trustee,” to transfer their assets into a trust during their lifetime and name a trustee to manage them. This means the trust “owns” all of the assets, and the trustee oversees them. Many people name themselves the trustee of their own trust, which allows them to use and control their property while they’re still alive. If the individual chooses this route, they should name a successor trustee to ensure a smooth transition of management of the trust funds after they become incapacitated or pass away, as well as beneficiaries to inherit upon their death.

Many people create a pour-over will alongside their trust. This allows the individual to name a guardian for their minor children and protect additional assets not transferred into the trust. If the individual owns assets and doesn’t transfer them into their trust before they pass away, a pour-over will transfers them after their death. Just like any will, however, a pour-over will must go through the probate process before any property can be transferred to the trust. If your supporters create an RLT with FreeWill, we include a pour-over will with their trust documents.

There are many different types of trusts, but they all fall into two categories: revocable (can be revoked or changed) and irrevocable (usually can’t be changed without a court order). Both have benefits and drawbacks, but revocable trusts are more common due to their flexibility. It is important to note that gift commitments in RLTs and wills are both revocable and can be changed during an individual’s lifetime. Therefore, our stewardship best practices can help you steward your FreeWill legacy donors regardless of their estate planning vehicle.

What are the differences between a trust and a will?

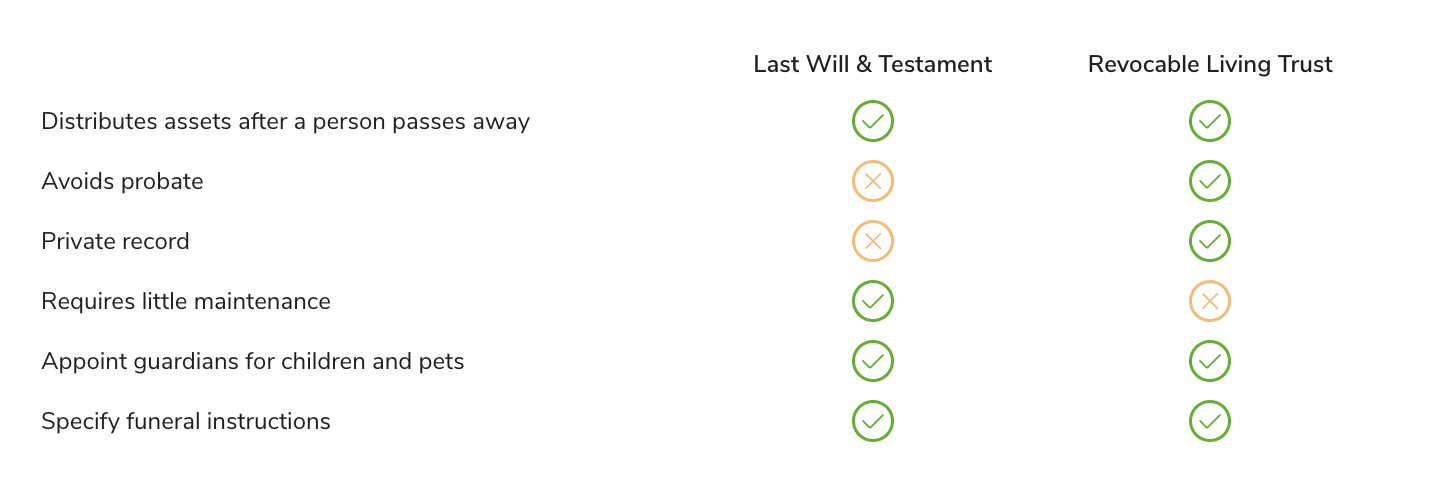

Both revocable living trusts and wills allow individuals to specify who they want to inherit their assets and property after they pass away, including nonprofit organizations. One of the most important differences between the two plans is whether they are required to go through probate — the court-supervised legal process of administering an estate after an individual passes away.

While every will must go through probate, assets transferred to an RLT during the individual’s lifetime avoid probate. RLTs can reduce (or even eliminate) probate fees, saving time and money for the individual’s beneficiaries. And while an RLT has no special tax advantages over a will, the cost savings on probate fees can be meaningful. In addition to avoiding probate, RLTs offer more privacy because they are not required to be part of the public record.

A second major difference is that RLTs require more maintenance. While wills are often revisited every 3-5 years, trusts require more significant maintenance and upkeep. If the grantor acquires a new asset, they would ideally transfer that asset to the trust as soon as possible. A trust will need continuous maintenance since the grantor will likely continue to acquire new property throughout their lifetime.

Trust vs. will: What are the benefits for users?

The need for a will or trust depends on individual circumstances and goals. For most Americans, a simple will is sufficient for their estate planning needs.

As mentioned above, an RLT can offer many benefits, such as avoiding the probate process, providing greater privacy, and allowing individuals to retain more control over their assets during their lifetime. Some instances where setting up a trust could be advantageous are:

- They have a large or complicated estate

- They own a business

- They want to avoid the cost and delay of probate court

- They want to keep their estate affairs private by avoiding the public probate process

- They own real estate property in different states

- They want better control of how and when their beneficiaries receive their inheritance

- They want to plan for incapacity

Ultimately, individuals will self-select the estate planning document they want to create on FreeWill. When in doubt, individuals can consult with a qualified estate planning attorney to decide what type of estate plan best serves their needs.

How does this benefit my organization?

As a FreeWill nonprofit partner, your organization provides a vital service by offering your supporters the tools and resources they need to make informed decisions about their legacy. The option to create an RLT is an additional benefit to your supporters and your organization. Gifts from RLTs can be considerably larger than those from wills, as more high-net-worth individuals may choose to create RLTs.

Additionally, by helping donors create an RLT and avoid the probate process, you may benefit from donors having more funds to commit to your organization.

By creating an RLT, your supporters can protect their assets and have more control over their distribution after they pass away. When a legacy donor leaves a gift in their RLT, their successor trustee can pay that gift out much faster, providing your organization with transformational gifts to support your mission.

Next steps

When you send outreach about your FreeWill estate planning tools, individuals will now have the opportunity to choose to create an RLT in addition to a will. We recommend you send outreach to a broad audience to ensure that all donors have access to these vital estate planning resources.

Users can also check out our FreeWill blog posts, including:

- Trust vs. will: What is the difference, and which one do I need?

- What is a revocable living trust?

- Which assets should you put in a living trust?

At FreeWill, we are dedicated to empowering your supporters to create lasting impacts through our warm, intuitive, and free estate planning tools, now including RLTs in all 50 states. If you have any questions, please feel free to contact your FreeWill Strategist.